Navigating European Vineyards: A Comprehensive Guide to Campervan, Motorhome, and Travel Insurance for UK Travelers

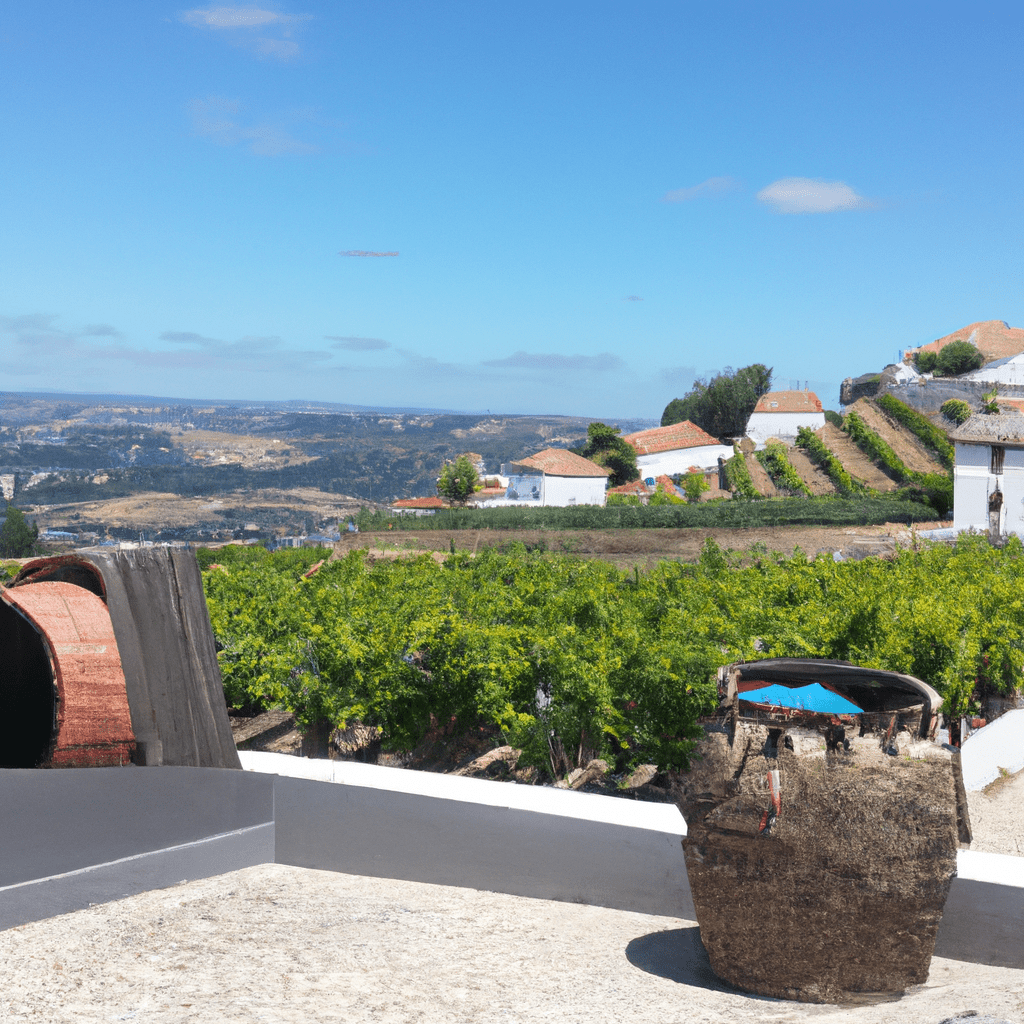

Embarking on a journey through the picturesque vineyards of Europe in your campervan or motorhome with your family is a dream come true. While the prospect of exploring charming landscapes and savouring local wines is exciting, it’s important to ensure your adventure is safeguarded by the right insurance coverage. This guide will walk you through the necessity of campervan insurance, the types of coverage available, and how to select the best insurance to suit your needs as a traveller based in the United Kingdom.

I am using the world’s friendliest online business engine…it’s free…forever!

Why Campervan and Motorhome Insurance is Essential: Insurance is not just a legal requirement but also a crucial safety net that protects you, your family, and your vehicle during your European journey. The unpredictability of travel, road conditions, and accidents make insurance indispensable. Comprehensive insurance offers financial protection against a range of risks, including:

Choosing the Best Campervan or Motorhome Insurance: Selecting the right insurance coverage for your campervan or motorhome journey requires careful consideration of your travel plans, budget, and specific needs. Here’s a step-by-step guide to help you make an informed decision:

- Accidents: Covering damages to your campervan and third-party vehicles in case of accidents.

- Theft and Vandalism: Protecting your vehicle from theft, break-ins, and vandalism.

- Natural Disasters: Offering coverage against damages caused by natural disasters like storms and floods.

- Medical Expenses: Assisting with medical bills in case of injuries sustained during an accident.

- Third-Party Liability: Providing coverage for bodily injury and property damage to third parties in accidents involving your campervan.

- Legal Expenses: Covering legal costs in case you’re involved in a legal dispute related to your campervan.

- Evaluate Your Travel Plans: Start by assessing the duration of your trip, the countries you plan to visit, and the type of roads you’ll be driving on. Some insurance policies may have limitations on travel duration or geographical coverage. Make sure your chosen insurance covers all the countries on your itinerary.

- Determine Coverage Types: There are three main types of campervan or motorhome insurance coverage:

a. Third-Party Only: Provides coverage for third-party bodily injury and property damage. This is the minimum legal requirement for driving in most European countries but offers limited protection for your campervan.

b. Third-Party, Fire and Theft: Offers coverage for third-party liabilities as well as protection against fire and theft of your campervan.

c. Comprehensive: Provides the highest level of coverage, including all the benefits of third-party, fire and theft insurance, along with coverage for accidental damage to your campervan.

- Additional Coverage Options: Depending on your needs, you can opt for additional coverage options, such as:

a. Breakdown Assistance: Provides roadside assistance and recovery services in case of mechanical breakdowns.

b. Personal Belongings: Covers the loss or damage of personal items inside your campervan.

c. Windscreen Cover: Offers protection against damages to your windscreen and windows.

d. European Travel Extension: Extends your coverage to specific European countries outside the UK.

- Compare Quotes: Obtain quotes from reputable insurance providers that specialize in campervan or motorhome insurance. Consider using online comparison tools to easily compare coverage and prices. Keep in mind that the cheapest option may not always provide the best coverage, so review policy details carefully.

- Read Policy Terms and Conditions: Thoroughly read and understand the terms and conditions of each insurance policy. Pay attention to exclusions, deductibles, claims procedures, and any limitations on mileage or travel.

- Check for Discounts: Inquire about available discounts, such as no claims bonuses, multi-vehicle policies, or discounts for advanced security systems. Some insurers offer reduced rates if you have a history of safe driving.

- Seek Recommendations: Reach out to fellow campervan enthusiasts or travel forums for recommendations based on their experiences. Personal testimonials can provide valuable insights into the quality of service and claims handling of different insurers.

- Review Customer Feedback: Look for customer reviews and feedback about the insurance companies you’re considering. Positive customer experiences and prompt claims processing are indicators of a reliable insurer.

- Consider Claims Process: Research the claims process of each insurance provider. A smooth and efficient claims process can greatly ease the stress of unexpected events. Check if they offer 24/7 claims assistance and how quickly they process and settle claims.

- Evaluate Customer Support: Responsive and helpful customer support is crucial, especially when you’re travelling abroad. Reach out to potential insurers with any questions you may have and assess their willingness to assist you. A reliable customer support team can be a valuable resource during your journey.

- Review Financial Stability: Investigate the financial stability of the insurance companies you’re considering. A financially stable insurer is more likely to honour their commitments and provide timely claims payments.

- Seek Professional Advice: If you’re unsure about specific policy terms or need guidance in selecting the right coverage, consider consulting with an insurance broker or advisor specializing in campervan insurance. They can provide personalized recommendations based on your unique requirements.

- Read the Fine Print: Before finalizing your decision, thoroughly read the policy documents, including the fine print. Ensure you understand all terms, conditions, and exclusions to avoid any surprises when you need to make a claim.

- Regularly Review and Update: Campervan insurance is not a one-time decision. Periodically review your coverage as your travel plans and needs may change. Inform your insurer about any modifications to your campervan or changes in your travel itinerary.

- Obtain Multiple Quotes: Don’t settle for the first quote you receive. Obtain quotes from multiple insurers and compare them side by side. This will help you identify the best value for your budget while ensuring you have adequate coverage.

Conclusion: Your campervan journey through the vineyards of Europe promises unforgettable experiences and cherished memories. However, safeguarding your adventure with the right campervan insurance is a responsibility that should not be taken lightly. By following the steps outlined in this guide, you can confidently navigate the intricate landscape of campervan insurance options and select a policy that suits your needs, budget, and travel plans.

Remember that the best campervan insurance or motorhome insurance is not just about getting the most coverage for the lowest price; it’s about finding the right balance between protection and affordability. A comprehensive insurance policy can provide you with the peace of mind you need to fully immerse yourself in the beauty of the European countryside, indulge in local flavours, and create lasting memories with your loved ones.

I am using the world’s friendliest online business engine…it’s free…forever!

As you set out on your adventure, equipped with the knowledge and guidance from this guide, you can embark on your European vineyard odyssey with confidence, knowing that you’ve taken the necessary steps to ensure a safe, enjoyable, and worry-free journey in your cherished campervan. Cheers to a remarkable journey ahead!